Late Payments and Credit Score: Recency, Frequency, and Severity

The magnitude of the negative effect of late payments on your credit score depends on three different factors: recency, frequency, and severity.

Recency refers to the length of time between the date on which the late payment occurred (and is memorialized on your credit report) and the date on which your credit report was used to calculate your credit score.

Frequency refers to the number of late-payment entries appearing on your credit report on the date on which your credit report was used to calculate your credit score.

Severity refers to how late your late payments were. There are four categories of late payments on credit reports using the standard Metro 2 format:

- 30 days late, which covers late payments of 30-59 days from the payment due date.

- 60 days late, which covers late payments of 60-89 days from the payment due date.

- 90 days late, which covers late payments of 30-59 days from the payment due date.

- 120+ days late, which covers late payments over 120 days from the payment due date.

Recency Errors

A very common cause of recency errors arises out of the misreporting of the account status for paid-and-closed accounts and transferred accounts that includes a late-payment history. The Credit Reporting Resource Guide (CRRG), which is the reporting standards guide for the Metro 2 format published each year by the Consumer Data Industry Association, sets forth guidelines for reporting codes to reflect the Final Account Status of closed and transferred accounts.

The Final Account Status for a paid-and-closed account should report as “paid and closed”. The Final Account Status of transferred accounts should report as “transferred”. We have found that the creditors often misreport or miscode the information for closed-and-paid accounts and transferred accounts when those accounts have a late-payment history.

For example, we often see a creditor report that the Final Account Status is 30, 60, 90, or 120+ late instead of reporting the account as paid and closed or transferred. This misreporting of the Final Account Status results in these tradelines being scored as if the current account status is a late-payment status. But if the creditor was reporting the correct Final Account Status of paid-and-closed accounts and transferred accounts correctly, the tradeline would be correctly scored based on the historical late payments. This can make a huge difference in your score.

An account with a Final Account Status consisting of current late payments has a much greater negative effect on your score than a Final Account Status with a historical late-payment history, in which the late payments occurred years in the past. This kind of error seems to appear most often with small creditors, especially smaller banks and credit unions, and student loan servicers.

As explained by credit guru Barry Paperno:

Of these groups of factors [i.e. recency, frequency, and severity], recency carries most of the scoring influence by far.

We can review your credit report for free to see if your credit score is being hurt because a creditor is reporting an incorrect Final Account Status on your credit report. Please call or email us today to set up a free consultation and credit report review.

Frequency and Severity Errors

One common error that leads to both frequency and severity errors is the misreporting of late payments arising out of a misunderstanding or miscalculation of missed payments under the Metro 2 guidelines.

According to the CRRG:

- A payment status of 30-days late means that payment is between 30-59 days past the payment due date.

- A payment status of 60-days late means that payment is between 60-89 days past the payment due date.

- A payment status of 90-days late means that payment is between 90-119 days past the payment due date.

- And a payment status of 120+ days late means that payment 120 days or more past the payment due date.

We have found that creditors often use the code for a 30-day late account status whenever a payment is late or missed rather than only when a payment is between 30-59 past the payment due date. This mistake leads to erroneous late-payment information appearing on a credit report. The erroneous late payment leads to a decrease in credit score arising out the late-payment status itself and an increased frequency of late payments. This error also leads to erroneous severity of late-payment history.

This initial misreporting of an account as 30-days late could lead to an account being erroneously reported as 60-days or 90-days late

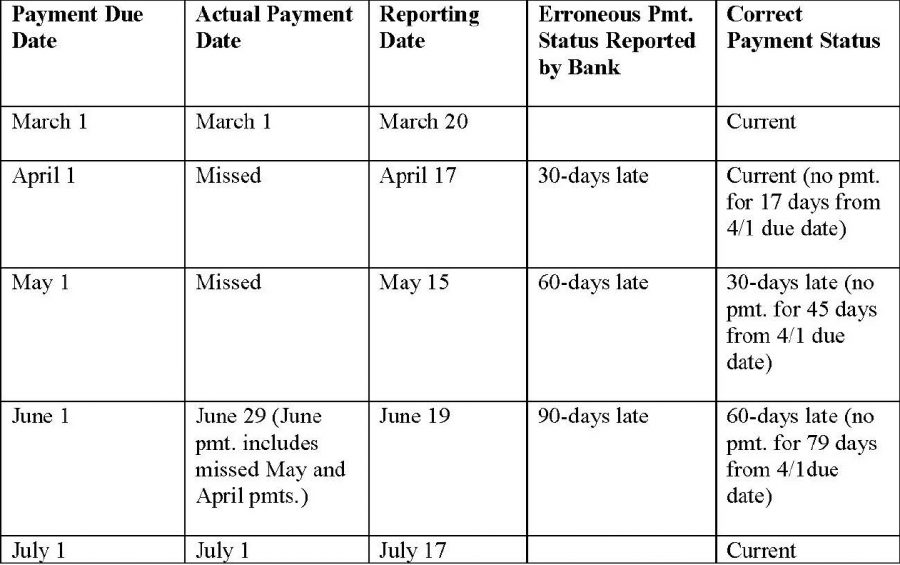

For example, a consumer has a mortgage with a payment due date falling on the first of each month. The loan servicer reports credit information to the consumer reporting agencies on the third Monday of each month. If the consumer missed his April mortgage payment, the servicer should not report that the consumer is 30 days late for April because, at most, on the date the loan servicer reports credit information to the consumer reporting agencies, the consumer would be no more than 21 days late from the date of payment due date.

Let’s assume that the loan servicer did erroneously report that the consumer was 30 days late in April and the consumer missed both her April and May payments. Under this scenario, the loan servicer should now report that the consumer was current in April and 30-days late in May. But the original error, will lead to the loan servicer misreporting that the loan as 60-days late in May. As a result, the frequency of late payments and the severity of late payments on the consumer’s credit report are both wrong, which leads to the consumer’s credit score being more negatively affected than if the loan servicer was reporting the late-payment history correctly.

The reporting error and compounding of that error is demonstrated in the table below.

We can review your credit report for free to see if your credit score is being hurt because a creditor is misreporting the late-payment status on accounts on your credit report. Please call or email us today to set up a free consultation and credit report review.